Car insurance does not cover intentional acts or damage caused by wear and tear or mechanical breakdown. Car insurance provides financial protection against unforeseen circumstances, but it has its limitations.

While it covers a wide range of risks, it can’t protect you from everything. Understanding what car insurance doesn’t cover is crucial to avoid surprises and make informed decisions. Certain activities or intentional acts, like participating in illegal activities or intentionally causing damage, are typically excluded.

Wear and tear, mechanical breakdowns, and regular maintenance expenses are also not covered. It’s essential to carefully review your policy, ask questions, and consider additional coverage options to ensure you have the right protection for your needs.

Understanding Car Insurance Coverage

Car insurance is a crucial safeguard that protects you financially in case of accidents, theft, or damage to your vehicle. However, it’s important to understand that car insurance coverage varies depending on the type of policy you have. While car insurance offers valuable protection, it’s equally important to be aware of what it does not cover. To help you make informed decisions, let’s explore the basic types of car insurance coverage and take a closer look at comprehensive coverage.

Basic Types Of Car Insurance Coverage

Before diving into what car insurance does not cover, let’s start by understanding the basic types of coverage that are typically included in most policies. These include:

- Bodily Injury Liability: Provides coverage for injuries caused to others in an accident where you are at fault.

- Property Damage Liability: Covers the cost of any property damage you cause in an accident.

- Personal Injury Protection: Offers coverage for medical expenses, lost wages, and other costs resulting from injuries sustained in an accident.

- Uninsured/Underinsured Motorist: Protects you if you’re involved in an accident with a driver who either has no insurance or insufficient coverage.

- Collision Coverage: Covers the cost of repairing or replacing your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: Provides protection against non-collision events such as theft, vandalism, natural disasters, and falling objects.

Comprehensive Coverage: An Overview

Comprehensive coverage is an essential component of car insurance that offers protection in various scenarios, beyond collisions. It typically covers damage caused by theft, vandalism, natural disasters, falling objects, fire, and sometimes even animal damage. For example, if your car gets stolen or damaged due to a falling tree branch, comprehensive coverage can help pay for the repairs or provide the value of your vehicle in case of total loss.

Despite its comprehensive nature, it’s important to understand that there are limitations to what comprehensive coverage can protect you from. For instance, it generally does not cover mechanical failures, wear and tear, or damages resulting from regular use or negligence. Additionally, some policies may also exclude coverage for specific perils like earthquakes or floods.

When considering comprehensive coverage, it’s advisable to carefully review your policy and consult with your insurance provider to fully understand the specific limitations and exclusions. This will help you make well-informed decisions and ensure you have appropriate coverage to protect your investment.

In conclusion, while car insurance coverage is designed to safeguard you from various risks on the road, it’s essential to be aware of its limitations. Understanding what car insurance does not cover ensures that you can plan and take additional steps to protect yourself financially in situations that fall outside the purview of your policy.

:max_bytes(150000):strip_icc()/buildawall.asp_Final-a5c4a02c9bf94fef9d648d7439cf0749.png)

Credit: www.investopedia.com

What Car Insurance Does Not Cover

Car insurance is essential for every driver to protect themselves and their vehicles from unforeseen events on the road. But, it’s important to understand that car insurance does not cover everything. There are specific exclusions and limitations that you need to be aware of. In this article, we will explore some of the common things that car insurance does not cover. Understanding these exclusions can help you make informed decisions about your insurance coverage and avoid any surprises when it comes to filing a claim.

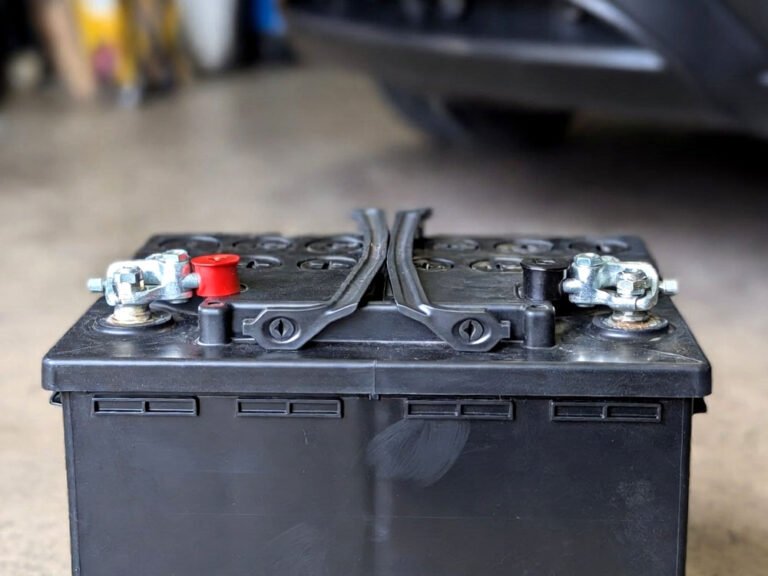

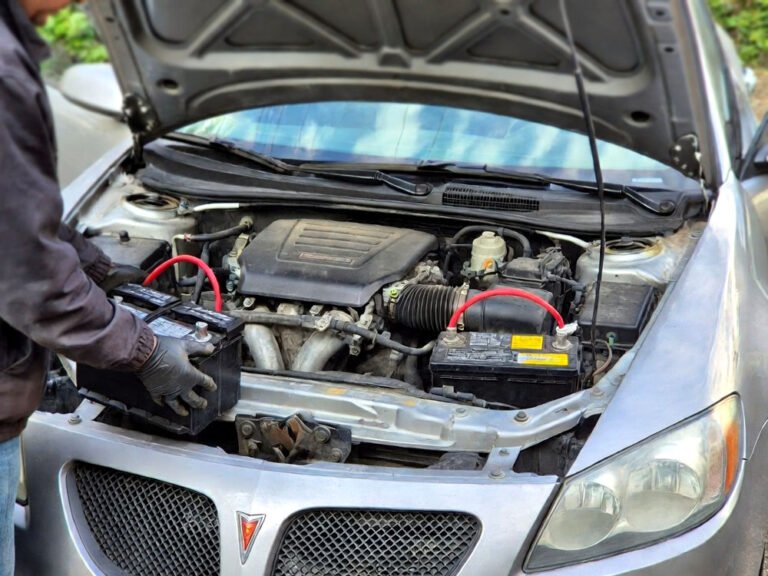

1. Mechanical Breakdown And Wear And Tear

When it comes to car insurance, mechanical breakdowns and wear and tear are typically not covered. While your policy may cover damages caused by accidents or collisions, it generally excludes repairs due to mechanical failures or the gradual deterioration of your vehicle over time.

Let’s say your car’s engine breaks down due to regular wear and tear. In such cases, you would need to cover the repair costs out of your pocket. A car insurance policy is designed to protect against sudden and accidental damage rather than routine maintenance or repairs caused by natural wear and tear.

2. Intentional Damage And Illegal Activities

Car insurance does not cover intentional damage or damage caused during illegal activities. If you purposefully vandalize your own car or engage in illegal activities such as racing on public roads, your insurance company will not provide coverage for the damages.

The purpose of car insurance is to protect against unforeseen events and accidents, not to encourage or support illegal behavior. So, it is important to be responsible and follow the law to ensure that you are eligible for insurance coverage when you need it most.

3. Personal Belongings And Customizations

Many people mistakenly believe that their car insurance covers personal belongings and customizations inside their vehicle. However, this is generally not the case. Car insurance is primarily designed to cover damages to the vehicle itself and injuries to individuals involved in accidents, rather than personal belongings or customizations like expensive sound systems, aftermarket modifications, or personalized accessories.

If your car is broken into and your personal belongings, such as a laptop or handbag, are stolen, you will typically need a separate insurance policy, such as homeowner’s or renter’s insurance, to provide coverage for those items.

4. Rental Cars And Non-owned Vehicles

When it comes to rental cars or vehicles that you do not own but are driving, car insurance may have limitations. While some policies provide limited coverage for rental vehicles, it’s important to check with your insurance company to understand the extent of this coverage.

If you frequently rent cars or use non-owned vehicles, you may want to consider purchasing additional coverage or a separate policy to ensure that you are adequately protected.

In conclusion, it is crucial to understand what car insurance does not cover to avoid any surprises when you need to file a claim. By familiarizing yourself with the exclusions and limitations of your policy, you can make informed decisions about your insurance coverage and consider additional policies if necessary. Remember that car insurance is designed to protect against unforeseen events and accidents, so routine maintenance, intentional damage, personal belongings, and certain types of vehicles may not be covered by your policy.

Additional Considerations For Comprehensive Coverage

When it comes to car insurance, it’s important to understand what is covered and what is not. While comprehensive coverage provides extensive protection, there are additional considerations that you should be aware of. This section will discuss three key aspects that can impact your comprehensive coverage – deductibles and coverage limits, optional coverage enhancements, and exclusions and policy limitations. Understanding these factors will help you make informed decisions to ensure you have the right level of coverage for your car insurance needs.

Deductibles And Coverage Limits

When purchasing comprehensive coverage, you will need to select a deductible and coverage limits. The deductible is the amount you will need to pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower insurance premiums, but it’s important to choose a deductible that you can comfortably afford in case of an incident. Coverage limits refer to the maximum amount your insurance company will pay for covered claims. It’s crucial to choose appropriate coverage limits to adequately protect yourself financially in the event of an accident or damage to your vehicle. Understanding deductibles and coverage limits will help you determine the right balance between potential out-of-pocket expenses and monthly premiums.

Optional Coverage Enhancements

In addition to comprehensive coverage, you may have the option to enhance your policy with additional coverage options. These optional enhancements can provide added protection beyond the standard coverage. Some common optional coverage enhancements include:

- Rental car reimbursement: This coverage helps cover the cost of a rental car while your vehicle is being repaired after an accident.

- Emergency roadside assistance: This coverage provides assistance if your car breaks down or you need emergency services like towing or locksmith services.

- Glass coverage: This coverage protects you from having to pay out of pocket for windshield or window repairs or replacements.

Optional coverage enhancements can provide valuable support during unexpected situations, but it’s important to assess your individual needs and budget before adding them to your policy.

Exclusions And Policy Limitations

While comprehensive coverage offers extensive protection, it’s essential to be aware of the exclusions and limitations within your policy. Exclusions typically include damages resulting from intentional acts, fraud, or using your vehicle for commercial purposes. Policy limitations may vary, but common examples include coverage restrictions for certain types of vehicles, modifications, or geographical limitations. Familiarizing yourself with these exclusions and policy limitations will help you understand the full extent of your coverage and avoid any unexpected surprises.

Credit: www.facebook.com

:max_bytes(150000):strip_icc()/liability_insurance.asp-final-5047623e88434455a627aabe9ab2bba0.png)

Credit: www.investopedia.com

Conclusion

Car insurance is crucial for protecting oneself financially in the event of an accident. However, it is important to understand that there are certain things that car insurance does not cover. This includes intentional acts, racing activities, wear and tear, and damage caused by natural disasters.

It is essential to review your policy carefully and clarify any doubts with your insurance provider to ensure you have comprehensive coverage. Stay informed and make informed decisions when it comes to your car insurance to avoid any surprises in the future.